Trouble in Euroland

Where oh where will that first financial domino fall? National Alliance Securities Head of International Fixed Income, Andy Brenner, told CNBC's Rick Santelli, when asked why investors are preoccupied with US Treasuries, “It’s called Italy.”

Bloomberg chimed in on the same subject. “Italian assets were pummeled again on mounting concern over the populist coalition’s fiscal plans, with the moves rippling across European debt markets.”

Little old Italy, you might ask. While small in land mass, the Italian government has borrowed mightily: the fourth largest bond market in the world, behind, China, Japan and you know who. That makes Italy the largest bond market in Europe. “You have to take what’s happening there seriously,” Brenner said. “This could be a major event for the dissolving of the EU.”

Political change is brewing in Italy and “Investors fret the anti-establishment parties’ proposal to issue short-term credit notes – so-called ‘mini-BOTs’ – will lead to increased borrowing in what is already one of Europe’s most indebted economies,” Bloomberg reports.

The 5-Star Movement and League are proposing “to ask the European Central Bank to forgive 250 billion euros ($296 billion) of Italian debt, according to a draft of a coalition program the parties are working on,” reports Reuters.

These political parties understand that no real people own their debt. The ECB conjured money from nowhere to the quarter billion euros worth of paper by way of its quantitative easing program.

Thus, despite Italy having a debt to GDP ratio of 130 percent, the yield on their 2-year bonds until a few days ago was negative. Yes, if you wanted to lend the basketcase Italian government money, you had to pay them, courtesy of Mario Draghi.

Italy’s two-year note is yielding all of 27 basis points as I write, despite, as Wolf Richter explains,

an over-indebted government that doesn’t control its own currency and cannot print itself out of trouble and whose new leadership – made up of the coalition of the Five Star Movement on the left and the League on the right – is proposing a haircut for its creditors to make the debt burden easier, and is also proposing the issuance of an alternate currency to give it more money to spend, even as it also promises to crank up government deficit spending and cut taxes too.

Will the ECB’s stifling of price discovery last forever? Richter thinks not, writing, “the ECB has tapered its bond purchases to €30 billion a month, and will likely end them this year. Leadership at the ECB will change in 2019, and Italy will lose its champion at the ECB.”

Meanwhile banking in Euroland is precarious. Professor Phillip Bagus, tells the story on mises.org and it's no small problem. “The Eurosystems´and euro banks´ balance sheets totaled €30 trillion in January 2018, that is about 291 percent of GDP,” writes Bagus.

Bagus lists seven reasons that European banks are in trouble. He mentions regulation cost rising but then there’s this,

there are risks hidden in banks´ balance sheets. That there is something fishy in European banks´assets can quickly be detected when comparing banks market capitalization with their book value. Most European banks have price-to-book ratios below 1. German Commerzbank´s price-to-book ratio stands at 0.49, Deutsche Bank´s is at 0.36, Italian UniCredit´s at 0.23, Greek Piraeus Bank at 0.14, and Greek Alpha Bank at 0.34.

What’s fishy? European sovereign bonds that yield less than zero likely tops the list.

Equally jaw-dropping is, “according to the ECB non-performing loans (NPLs), i.e. loans where borrowers have fallen behind in their payments, amount to €759 bn., that is 30% of the banks' equity,” professor Bagus writes.

Additional time bombs on bank balance sheets are loans to zombie companies only surviving due to negative, or close to it, interest rates. When the ECB suspends QE and rates normalize, businesses will fail and banks will be loaded with more bad credits.

Finally, on Bagus’s list is, “banks in the Eurozone are still connected closely to their government. As of January 2018, Eurozone banks held €3.536 bn. Government debt on their books which amounts to 13% of their balance sheet total. When in the next recession, the sovereign debt crisis looms again banks can expect losses on their sovereign debt portfolio.”

If all that isn’t enough, in nearby Turkey, the Lira has plunged in value and is close to five to the dollar. Erdogan’s country has a share of the $250 billion worth of emerging market debt coming due next year.

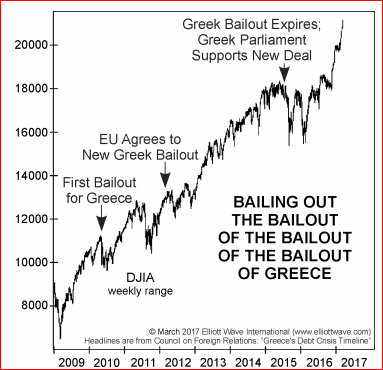

Imagine the Greek crisis on steroids.