Grexit Spells Trouble For Trump's Bubbleland

Donald Trump’s popularity, at least among the 44% who approve of the job his scandal-a-day administration is doing, had political pundits scratching their heads during a Sunday cable news afternoon talk show. “Why Wall Street Matters” author William Cohan quickly butted in to make the point that record stock market prices has the investor class on both coasts “giving Trump a pass.” If the DJIA was 13,000 rather than 21,000, those folks would be turning on him, not just Madonna and all those gals wearing pussy hats.

Not to worry, the Trump rally hasn’t sent stocks into bubbleland, says Warren Buffett,"Measured against interest rates, stocks are actually on the cheap side." The Sage of Omaha would be making a lot more sense if companies were making more money. However, earnings have been flat since 2011. Wolf Richter “posted a chart that showed that earnings of the S&P 500 companies in Q4 2016 were back where they’d been in Q4 2011. So five years of earnings stagnation. Yet, during those five years, the S&P 500 index soared 87%.”

The price earnings ratio for the S&P 500 has nearly doubled from 14.87 in 2012 to 26.75 on January 1st of this year. In Trump’s first network interview from the White House he discussed success in his first week in office, which included the Dow hitting 20,000. “The first time in history. I’m very proud of that,” the president told ABC News. “Now we have to go up, up, up.”

The next month it did. “The Dow closed higher for 12 consecutive days from February 9 through February 27, a most unusual feat,” explains the Elliott Wave Financial Forecast (EWFF). There have only been two longer streaks, one in 1987 and another in 1897. Streaks like this occur when stocks are rebounding, accelerating, or at the top.

Investor psychology is off-the-charts, with trader sentiment over 90%, newsletter sentiment over 69%, and “At 63.8% bulls, the most recent Investors Intelligence Advisors’ Survey is higher than every weekly reading since January 1987,” explains EWFF.

While stock traders bask in higher prices with their rose-colored glasses on, storm clouds are gathering in the form of another Greek bailout and problems with Italy’s banks, where 20% of loans are past due. Italy is close to Greece in debt service with 5.5% of economic output going to debt service right behind the Greek’s 6.1%.

A Financial Post headline blares, “Greece is about to run out of cash. Again. But this time a bailout might not be coming.” The biggest bone of contention between Greece and the IMF is pensions. The current pensions system is “unaffordable” and financed by “high tax rates on narrow bases,” the IMF said. Narrow indeed, only half of working Greeks pay taxes. And, the unemployment rate is nearly 25%.

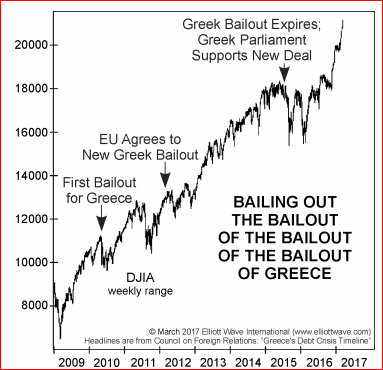

Investors may have forgotten that the U.S. market swoons when Greeks get handouts. July will be here soon and the Greeks owe a $7.42 billion bond payment they have no hope of paying. The IMF claims it won’t continue to put money in the hat the Greeks have in hand and the EU is said to rule out “any further relief before 2018. “ “Failure --and a Grexit--looks inevitable.”

Brexit foretold good things for The Donald. A Grexit likely will not.