Testosterone, the Austrian Business Cycle, and the Madness of Central Bankers

The stock market is at all-time highs. Argentina, a serial defaulter just sold $2.75 billion worth of debt with a 100-year maturity. Commercial real estate is booming again. All of this irrational exuberance while the world’s government’s are over indebted, economies are punk, and hostilities are prevalent everywhere.

Are memories too short? Or testosterone too high? Therese Huston, cognitive psychologist at Seattle University, writes for The New York Times,

Researchers have shown for years that men tend to be more confident about their intelligence and judgments than women, believing that solutions they’ve generated are better than they actually are. This hubris could be tied to testosterone levels, and new research by Gideon Nave, a cognitive neuroscientist at the University of Pennsylvania, along with Amos Nadler at Western University in Ontario, reveals that high testosterone can make it harder to see the flaws in one’s reasoning.

Ms. Huston goes on to explain that people with high levels of testosterone have less activity in their “orbitofrontal cortex, a region just behind the eyes that’s essential for self-evaluation, decision making and impulse control.”

Our orbitofrontal cortex keeps us in check, makes us look before we leap, and maybe not be so sure of ourselves, except for those with a heaping helping of testosterone.

Tests show that males tend to be very sure of themselves, even when wrong. Huston writes, “compared with women, men tend to think they’re much better than average.”

Actually the point of Huston’s piece is to question the taking of testosterone supplements. Because, while a little more T may give older guys a bit more get up and go, supplement taking men “were also rushed in their bad judgment and gave incorrect answers faster than the men with normal testosterone levels, while taking longer to generate correct answers.”

In a piece for mises.org back in 2008 I wondered, “Does Neuroscience Support Austrian Theory?”

The focus of the piece was dopamine, a chemical in the brain that helps humans decide how to take actions that will result in rewards at the right time. The dopamine rush only happens when an unexpected windfall is made.

A drop in interest rates engineered by an expansion in liquidity by a central bank, "falsifies the businessman's calculation," Ludwig von Mises explained in Human Action. "The result of such calculations is therefore misleading. They make some projects appear profitable and realizable which a correct calculation, based on an interest rate not manipulated by credit expansion, would have shown as unrealizable. Entrepreneurs embark upon the execution of such projects. A boom begins."

Computational neuroscientists would add that not only do the projects appear profitable on paper but also that dopamine is released into the brains of entrepreneurs as they anticipate future profits.

Ms. Huston refers to work done by two neuroscientists using 140 male traders in their experiment.

The results are disturbing. Men with boosted testosterone significantly overpriced assets compared with men who got the placebo, and they were slower to incorporate data about falling values into their trading decisions. In other words, they created a trading bubble that was slow to pop.

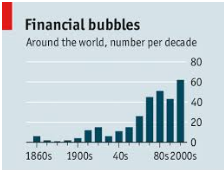

With the world’s central banks flooding the world with liquidity pushing interest rates to nearly nothing, bubbles emerge, pop, and emerge again. Yet people never learn.

John Coates, a Canadian-born research fellow in neuroscience and finance at the University of Cambridge and a former trader at Goldman Sachs and Deutsche Bank, believes he has the answer. “Once you start making above-average profits, as most people do during a bull market, you start getting this high,” he says. “I think it’s enough to pretty much squash memory” of previous bubbles.

Coates himself, equipped with a PhD in economics, has fallen victim to the testosterone highs. “I don’t think I ever would have hit on this if I hadn’t experienced it myself,” he says. “We have an unstable biology, and it’s very powerful.”

Powerful enough that someone as brilliant as Sir Isaac Newton went broke chasing the South Sea Bubble. Newton piled into South Sea Company shares early and sold early at a profit. However, “he then watched with some perturbation as stock in the company continued to rise.”

Newton bought back in near the top and sold near the bottom. This prompted him to allegedly say, “I can calculate the movement of stars, but not the madness of men.”

Central bankers, throughout history, have created madness. Their treachery continues unrelenting.