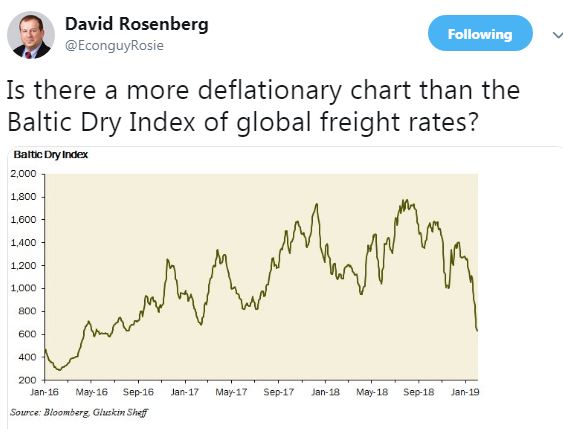

Central Banks Buy Gold, Baltic Dry Index Sinks

David Rosenberg tweeted a graph of the plunging Baltic Dry Index with the comment, “Is there a more deflationary chart than the Baltic Dry Index of global freight rates?”

Perhaps, or there is the New York Times business headline, “Some Central Banks Have Gold Fever, and It Might Be Sensible.”

However, central banks are notoriously bad in timing gold purchases.

Swaha Pattanaik slams gold enthusiasts while praising central bankers.

Gold bugs aren’t always rational. That’s not the case for central banks, whose purchases of the yellow metal last year were the highest since the United States broke the link between gold and the dollar in 1971.

Pattanaik gives us the numbers.

Central banks bought 651.5 tonnes of gold in 2018, the second highest annual total on record and up 74 percent from the year earlier, according to the World Gold Council. As in the past three years, Kazakhstan, Russia and Turkey were significant buyers, but were last year joined by the likes of Hungary, India and Poland.

Gordon Brown’s infamous sale of UK gold cost the Bank of England nearly £5 billion.

Christopher Hope wrote for The Telegraph in January 2009,

The sale of more than half of the country's gold reserves between 1999 and 2002 has proved to be deeply controversial.

Critics say that signalling such a large sale of bullion to gold traders helped to drive the precious metal to a 20-year low.

In 17 auctions, Mr Brown as Chancellor of the Exchequer sanctioned the sale of 395 tonnes of gold.

February Elliott Wave Financial Forecast