Musk's Tesla Trump Trick Flops

Ralph Keyes has a book out called “The Post-Truth Era.” He writes,

This is post-truth. In the post-truth era, borders blur between truth and lies, honesty and dishonesty, fiction and nonfiction. Deceiving others becomes a challenge, a game, and ultimately a habit. Research suggests that the average American tells lies on a daily basis. These fibs run the gamut from “I like sushi,” to “I love you.”

The President lies, over 4,229 and counting at 7.6 false claims per day. Politicians have always lied. They can get away with it. There are no market forces to prove their lies wrong, just some journalist looking up stats and pointing out the falsehood after the fact. Yawn.

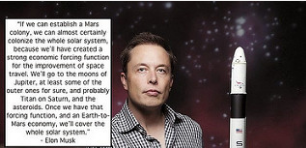

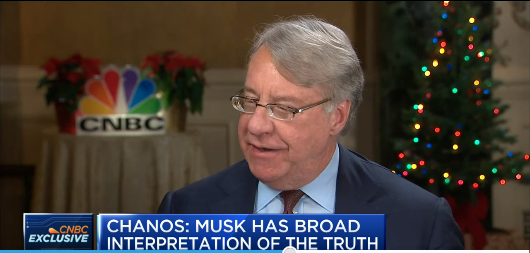

However, entrepreneurs and business people cannot lie around the market. If they make outlandish promises, the markets punish them. Ask Elon Musk, whose Tesla Trump trick recently flopped.

Musk said he was taking electric vehicle company Tesla private at $420 per share on August 7th. ‘Funding assured’ he tweeted. Wolf Richter writes,

The ludicrousness of his lie that had instantly spread all over the world had an unintended consequence for eons to come: The term “funding secured” can never again be pronounced with a straight face.

The market didn’t believe Musk could raise $50 billion to complete such a deal and the stock price remained 20 percent below the buyout price. Tesla’s stock price has sunk from there, closing at $280.95 today. The market is worried that Musk can only keep Tesla going with more capital raises. Meanwhile, Musk has tweeted that the company will be cash flow positive in Q3 or Q4 2018. This would be an ultra-sudden turnaround for a company that’s lost $5.7 billion in total and burned through $1.9 billion in the first half of 2018 alone.

Musk, according to Bill Maurer, has told 125 and counting official lies. Maurer is nice and calls it a failure list.

Further up in the capital stack, bondholders are getting nervous. Richter explains,

The $1.8 billion in senior unsecured notes, due in 2025, that Tesla sold in August 2017 fell to a record low of 85.69 cents on the dollar today. Investors that acquired them at issuance are down over 14%. This chart via FINRA and Morningstar depicts the entire life of those bonds:

Musk may think highly of himself and his company but ratings agencies, not so much. The bonds are rated six notches into junk (B-) by Standard and Poor’s and seven notches into junk (Caa1) by Moody’s.

Tesla suppliers are also getting skittish. A survey by the Original Equipment Suppliers Association (OESA), which represents automotive suppliers, was revealed on Wolf Street:

18 of 22 respondents believe Tesla is now a financial risk to their companies.

13 of 23 respondents said Tesla requested a “large” price reduction on current business and/or retroactive rebates. This is an issue that became public on July 23.

11 of 23 respondents said Tesla had asked them to extend payment terms.

8 of 22 respondents said they were worried that Tesla might file for bankruptcy.

But all of the respondents said they wanted to continue or grow their business with Tesla – which is logical, as long as they’re getting paid.

If the company doesn’t raise cash soon, it’s all over for the suppliers. Tesla’s Accounts Payable jumped 26% year-over-year, to $3.0 billion at the end of Q2 2018.

We’ve been led to believe that every Tesla that rolls off the factory floor is spoken for. However, inventories have jumped by nearly 50% year-over-year, or by over $1 billion, to $3.3 billion at the end of Q2 2018.

This might explain what happened to the 17,000 Model 3 cars that Tesla claimed to have “produced in the first half but did not “deliver” – as documented by endless photographic and video evidence of huge parking lots full of these cars.

Tesla bond holders are counting on Musk being able to sell more stock. Tesla stockholders are counting on Musk being able to sell more bonds. Musk can tell all the fibs he wants, eventually Wall Street will say no.