The Art of Madness: Picking a Fight with America's Largest Foreign Creditor

Ex-Wharton student and WWE hall of famer, Donald J. Trump, is thinking $30 billion isn’t a large enough smackdown to those Intellectual property (as if that’s a legitimate thing) stealing Chinese. Trump urged US Trade Representative Robert Lighthizer to aim bigly, warning those during the tariff powwow that they should prepare for an announcement during the coming weeks.

Politico reports,

“Steel tariffs are one thing. Taking on the entire Chinese industrial policy apparatus that is designed to suck technology out of the world is another,” said one outside adviser to the administration who has been briefed on the planning and was not authorized to speak on the record

Beijing doesn’t plan to take this lying down, according to the Wall Street Journal.

China is preparing to hit back at trade offensives from Washington with tariffs aimed at President Donald Trump’s support base, including levies targeting U.S. agricultural exports from Farm Belt states, according to people familiar with the matter.

As Frédéric Bastiat wrote, “In the economic sphere an act, a habit, an institution, a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them.”

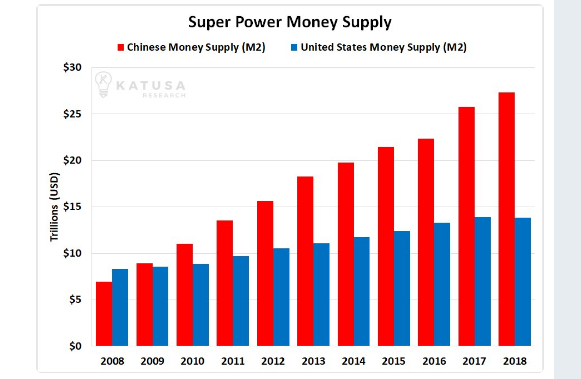

I don’t pretend to have any answers as to the results of this trade kerfuffle, should it happen. However, Jim Grant wrote a couple weeks ago in Grant’s Interest Rate Observer, “The whole world lives at the end of the whip of China’s credit growth.”

China, as large and populous as it is, might be considered a bank with a country attached. “The sheer size of China’s financial system is hard to grasp,” writes Mr. Grant’s right hand man, Evan Lorenz. “It is literally fantastic. As of Dec. 31, 2017, assets in Chinese commercial banks stood at $40 trillion, or 50.5% of total world GDP. (my emphasis) There is no precedent for a banking system this great.”

Lorenz tells us China’s GDP is $13.1 trillion, while America’s GDP is $19.4 trillion. U.S. commercial bank footings total $17.4 trillion. The People’s Bank of China (PBoC) has been papering over bad loans for decades, as I wrote about Carl E. Walter and Fraser J.T. Howie’s book Red Capitalism: The Fragile Financial Foundation of China's Extraordinary Rise. on Mises.org in 2011, “As nonperforming loans are pushed from good banks to bad, with China's Ministry of Finance providing its guarantee to the bad loans at par, banking life goes on, and the economic miracle remains alive, backstopped by the lender of last resort, the People's Bank of China, levered at 1,233 to 1. The result is underlying assets are never liquidated and zombie banks and crony-led corporations are left in place to squander capital.”

One of the footnotes of th crash of 2008 was the collapse of Iceland, chronicled by David Howden and Philipp Bagus, in their book “Deep Freeze.” In their introduction, Howden and Bagus write of a surging banking system,

During the several years leading up to the collapse, Iceland experienced an economic boom. The Icelandic financial system expanded considerably; a nation with a population only slightly larger than Pittsburgh, Pennsylvania and a physical size smaller than the American state of Kentucky erected a banking system whose total assets were ten times the size of the country’s GDP.

Ultimately, the country’s currency collapsed, taking it’s banking system and the entire economy with it. Howden and Bagus believe Iceland’s crisis was “the result of two banking practices that, in combination, proved to be explosive: excessive maturity mismatching and currency mismatching.”

Money flooded into Iceland leading to malinvestments that the crash would unwind. China’s self-made money creation has taken malinvestment to an absurd level. Prices for residential building lots increased 126% in just the past two years. “Coming to the end of their ability to find investment projects,” Grant’s cites Anne Stevenson-Yang as writing, “some cities have adopted a strategy of destroying new but unused buildings and public facilities in order to make room for more, since construction adds to GDP.”

However, Grant’s reports of three failed Beijing land auctions in January, suggesting, “the real estate market is far from its old bubbly self.” Should asset prices tank, renminbi will surely flee, putting downward pressure on the currency’s price and accentuating Trump’s drum beat for (trade) war.

China holds the world’s largest foreign-exchange reserves, at $3.1 trillion. Bloomberg recently reported,

China’s portfolio of U.S. bonds, notes and bills sank to $1.17 trillion in January from $1.18 trillion a month earlier, according to Treasury Department data released Thursday. China remains the largest foreign creditor to the U.S., followed by Japan, whose holdings rose for the first month since July, to $1.07 trillion from $1.06 trillion.

President Trump continually tells crowds how smart he is. However, pursuing a trade war with your largest creditor, who just happens to have a financial system on the edge of insolvency, is a recipe for exploding interest rates and a financial meltdown. Brilliant.