Fed Decelerates True Money Supply Growth, Liquidity Event Dead Ahead

Talking heads at CNBC and a couple guests seemed to go round and round the other day as to whether the Fed’s January board minutes were hawkish or dovish. However, Jeffrey J. Peshut, the proprietor of Realforecasts.com, has offered up a piece entitled, “What Does The Dramatic Deceleration In The Growth Of The True Money Supply Mean For Real Estate Investors?” as his latest installment in tracking the Fed’s moves using True Money Supply, a measure developed by Murray Rothbard and Joe Salerno.

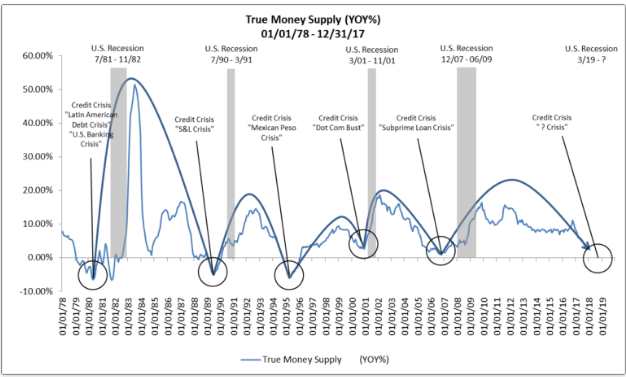

The end of quantitative easing (QE) and the beginning of quantitative tightening (QT) reflects a much tighter Fed today. Peshut writes, “In response to the Fed’s increasingly tighter monetary stance, the growth rate of TMS has decelerated dramatically, from 11.15% YOY in October of 2016 to 3.10% YOY in December of 2017.”

So, no matter what they say on tout TV, it’s Peshut’s view, who publishes Realforecasts for real estate investors who are trying to read the Fed’s tea leaves to earn a living, not academics simply theorizing about these things,

RealForecasts.com expects that the growth of TMS will continue its downward trend in the months ahead, as the Federal Open Market Committee continues to raise the Fed Funds Target Rate and reduce its balance sheet. Based upon the current trajectory of this trend, and the Fed’s current policy stance, it looks like the next credit and liquidity crisis could occur during the second half of 2018, with an economic recession and real estate market downturn to follow. Of course, this forecast could change if the Fed changes its policy stance or if the commercial banks change their pace of lending activity.

Tracking TMS has extraordinary predictive power as the chart RealForecasts.com reflects. When the central bank slows down money creation a liquidity event occurs signalling the start of a clearing of the malinvestments made during the easy money created boom.

If you’re wondering what the definition of True Money Supply (TMS) is, Mike Pollaro explains on Forbes,

TMS1: Austrian measure of money supply based on a narrow interpretation of U.S. money substitutes. It is the sum of Currency in Circulation plus Demand and Other Checkable Deposits plus Demand Deposit Sweeps; i.e., deposits which are immediately convertible, par value claims to currency, transferable on demand by check or electronic transfer. Under this formulation, Savings Deposits are excluded from the money supply on the basis that they, being legally subject to a potential 30-day redemption notice period, are credit claims – i.e., not immediately convertible par value claims to money, but instead claims to future money – and thus not true money substitutes. Excluded are Time Deposits and MMMFs as they represent true credit claims. The TMS1 formulation is most closely associated with economist Frank Shostak’s AMS metric.

TMS2: Austrian measure of money supply based on a broad interpretation of U.S. money substitutes. Here, Savings Deposits are included in the money supply on the basis that the 30-day notice period has rarely if ever been enforced, and unlikely to be enforced except perhaps in a systemic banking crisis where the government would very likely mandate a freeze on all bank deposits (making savings deposits no different than demand or any other deposit). For these reasons, the notice period is effectively non-existent, making savings deposits true money substitutes. TMS2 is most closely associated with economists Murray Rothbard / Joseph Salerno’s TMS metric.