Cryptomillionaire: the Smartest Guy at the Table (for now)

The question on (seemingly) everyone’s lips at the Property and Freedom Society conference was “what do you think of bitcoin?” Breakfast, lunch and dinner, meant discussing bitcoin, bitcoin, bitcoin.

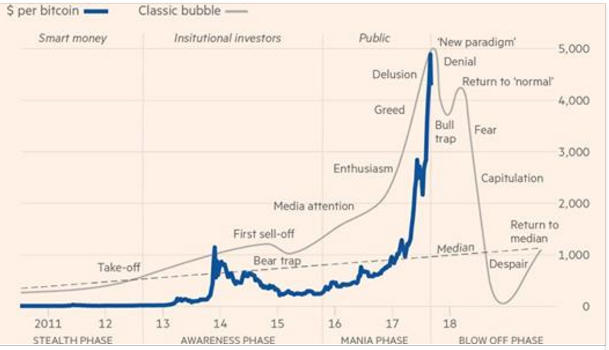

One young cryptomillionaire (at least he claimed) would have none of the bubble talk. After all, bitcoin, he said was “anarchy in action” and he, having been a libertarian since way back in 2014, believes this is just the start of a new movement to real freemarket money that could take the price of the cryptoworld's #1 brand to 5 figures, or 6.

My reflections on a certain real estate bubble and how it seemed similar to his acute certainty of how the future would progress made no dent in his enthusiasm. He owns a portfolio of 18 different cryptocurrencies, of which his memory could only produce 3 or 4 when asked to name them.

But, who cares, they will only go up. Or to put it another way, the lowly U.S. dollar, Euro, and gold will shrink into oblivion. He argued the price of the yellow metal could go to zero. I and a gentleman that has written plenty about money begged to differ. But being bubble rich means, being the smartest guy at the table.

James MacKintosh writes the opposite view in the Wall Street Journal article entitled "Bitcoin’s Wild Ride Shows The Truth: It Is Probably Worth Zero,"

Technological disruption may be overturning many societal norms, but securing society-wide recognition as a safe asset takes more than the backing of tech evangelists and a bunch of get-rich-quick stock promoters.

Upon returning home, I see others have been weighing in on all things crypto.

John Hathaway, manager of the $1.2 billion dollar Tocqueville gold fund, told Kitco the crypto craze was, “garbage. It's an absolute bubble-there's no question in my mind that it's in a bubble,” he told Daniela Cambone. “The idea that cryptocurrencies have somehow diverted interest in gold is baloney, it's just not true.”

Fred Hickey says the crypto currencies are not a store of value. While he’s a believer in the value of blockchain technology, he compared the price action to “chain-letter like scams.”

Ray Dalio, who manages $160 billion (presumably more than the cryptomillionaire I spoke with) for Bridgewater Associates, appeared on CNBC's Squawk Box, and said he doesn't think bitcoin is "an effective storehold of wealth", comparing it unfavorably to gold.

"It's not an effective storehold of wealth because it has volatility to it, unlike gold. Bitcoin is a highly speculative market. Bitcoin is a bubble," he said. "It’s a shame, it could be a currency. It could work, conceptually, but the amount of speculation that is going on and the lack of transactions [prevent it]."

Ron Insana writes for CNBC, “Bitcoin is in a bubble, make no mistake. The episode, for some, will end badly while others reap the rewards of getting in on the action early and, more importantly, getting out before the bust.”

There have been speculators who have made spectacular gains from bubbles. For instance, among the first to cash in on the Mississippi Bubble was Irish banker Richard Cantillon, who was a friend of the architect of the scheme, John Law.. Author Judy Gleeson suspects that Cantillon had inside information when he bought his shares cheap, and later benefited again from information that his brother provided: Bernard Cantillon had supervised the prospecting party that sailed to Louisiana, finding not the treasure that Law's propaganda claimed, but instead disease and hostile natives.

Cantillon not only sold, but, as Edward Chancellor writes for Reuters, “In 1720, Cantillon wagered against the French currency, which later fell by 60 percent in sterling terms.Chancellor writes,

Operations to reduce rates with freshly printed money also provided an opportunity for corruption, as large fortunes could easily be made. Cantillon argued that Law’s monetary experiment might temporarily reduce interest rates and incite speculation but the newly printed notes didn’t actually enter into the real economy: “The excess banknotes, made and used on these occasions, do not upset the circulation, because they are used for the buying and selling of stock they do not serve for household expenses and are not changed for silver.”

Pouring central bank created money into Cryptocurrencies, in hindsight, will look as foolish as buying Mississippi Company shares.