Bitcoin Showdown

Investment guru Bill Miller and his son, Bill Miller IV, are big bitcoin bulls, believing the digital currency whose price has soared this year is bound for disruptor status.

"It is a true disruptor and true innovation in money," the elder Miller told CNBC. "We haven't seen that in thousands of years."

F.A. Hayek’s dream of competing currencies is here. The list of crypto-currencies goes on and on, with the big news being what Bloomberg calls Bitcoin’s Civil War.

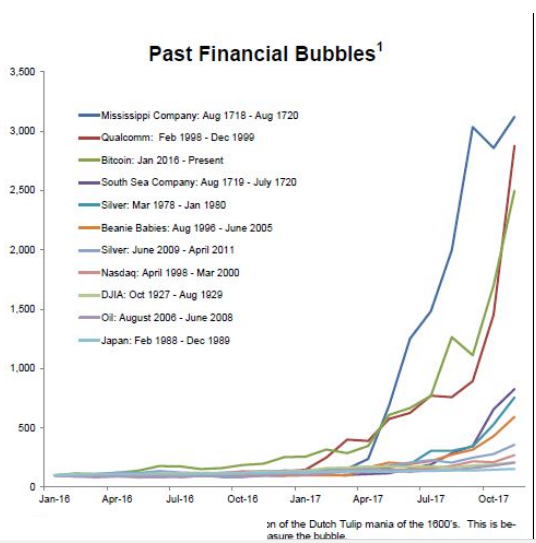

“The notoriously volatile cryptocurrency, whose 150 percent surge this year has captivated everyone from Wall Street bankers to Chinese grandmothers, could be headed for one of its most turbulent stretches yet,” write Lulu Yilan Chen and Yuji Nakamura.

It turns out opposing camps have been dickering for a couple years and “are poised to adopt two competing software updates at the end of the month” raising the possibility of bitcoin splitting in two, “an unprecedented event that would send shockwaves through the $41 billion market.”

There is no Janet Yellen in the crypto-world to arbitrate this sort of monetary brouhaha. Decentralization is the silky petals of the crypto flower, but this battle between the miners and what is known as Core, a group of developers is thorny and no one knows how it will come out.

Modern bitcoin miners have acres of warehouse space loaded with computers creating coins. Miners simply want the block size limit increased. The developers “insist that to ease blockchain’s traffic jam, some of its data must be managed outside the main network. They claim that not only would it reduce congestion, but also allow other projects including smart contracts to be built on top of bitcoin.”

The limited block size protects the integrity of the system, but has decreased it functionality and ability to compete as a payment processor.

Chen and Nakamura write,

Behind the conflict is an ideological split about bitcoin’s rightful identity. The community has bitterly argued whether the cryptocurrency should evolve to appeal to mainstream corporations and become more attractive to traditional capital, or fortify its position as a libertarian beacon; whether it should act more as an asset like gold, or as a payment system.

This split in the bitcoin world will test Hayek’s theory,

In this condition the value of the currency issued by one bank would not necessarily be affected by the supplies of other currencies by different institutions (private or governmental). And it should be in the power of each issuer of a distinct currency to regulate its quantity so as to make it most acceptable to the public-and competition would force him to do so. Indeed, he would know that the penalty for failing to fulfil the expectations raised would be the prompt loss of the business. Successful entry into it would evidently be a very profitable venture, and success would depend on establishing the credibility and trust that the bank was able and determined to carry out its declared intentions. It would seem that in this situation sheer desire for gain would produce a better money than government has ever produced.

Hayek continued,

The competition between the issuing banks would be made very acute by the close scrutiny of their conduct by the press and at the currency exchange. For a decision so important for business as which currency to use in contracts and accounts, all possible information would be supplied daily in the financial press, and have to be provided by the issuing banks themselves for the information of the public. Indeed, a thousand hounds would be after the unfortunate banker who failed in the prompt responses required to ensure the safeguarding of the value of the currency he issues.

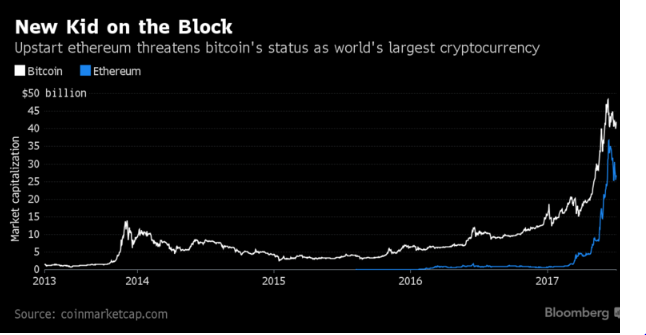

The bitcoin spat has led to an increase in the price of ethereum, “a newer cryptocurrency whose popularity has soared thanks to its ability to run smart contracts and its more corporate-friendly approach.”

Bloomberg provides a calendar of the coming showdown.

By July 21: SegWit2x software is released and supporters begin using it.

July 21 to July 31: The community monitors how many miners deploy SegWit2x:

If more than 80 percent deploy it consistently, that should signal community-wide adoption of SegWit and the avoidance of a split, at least for now.

But if a majority do not deploy, expect anxiety within the community to grow as the focus shifts to the Aug. 1 deadline.

Aug. 1: UASF is deployed by its supporters, who begin checking if bitcoin transactions are compliant with SegWit.

If a majority of miners still do not deploy SegWit2x or otherwise accept SegWit, and if UASF supporters do not back down, then two versions of bitcoin’s blockchain could come into existence: a UASF-backed one where only SegWit transactions are recognized, and another where all trades -- SegWit and non-SegWit -- are recognized.

If a split occurs, bitcoin will likely begin existing on both blockchains in parallel, resulting in two versions of the cryptocurrency. Expect traders to quickly re-price the value of both, likely leading to massive volatility.

Stay tuned.