Old Fed or New Fed, Rates are Headed Up

The Fed’s PhD standard is coming to an end, says Mark Grant. "The Fed of today is not going to be the Fed of tomorrow," the chief strategist at Hilltop Securities told "Squawk Box."

While Janet Yellen talks about further rate hikes, her board is loaded with vacancies and her and her second, Stanley Fischer, have terms expiring next year. "I think what the Fed says at this point is, for all practical purposes, irrelevant, because Mr. Trump is going to be able to appoint three members of the Fed," Grant said. "I think they're going to be business people and the days of an academic, economist Fed are going to be over."

Grant says Trump’s infrastructure plans and the government’s bloated debt require low rates, "So all this talk of a three interest rate or four interest rate hike, in my opinion, is baloney," says Grant.

Besides, Ms. Yellen, "critically fears that markets, that asset prices are subject to downturns and in some cases significant downturns – not black swans, but maybe gray swans – and so she wants to move on a gradual basis and indicate that to the marketplace," Bill Gross told CNBC.

But, does the Fed really set interest rates or follow the market? Robert Prechter writes, “As it has amply proved in recent years the Fed is impotent to force market rates up or down.”

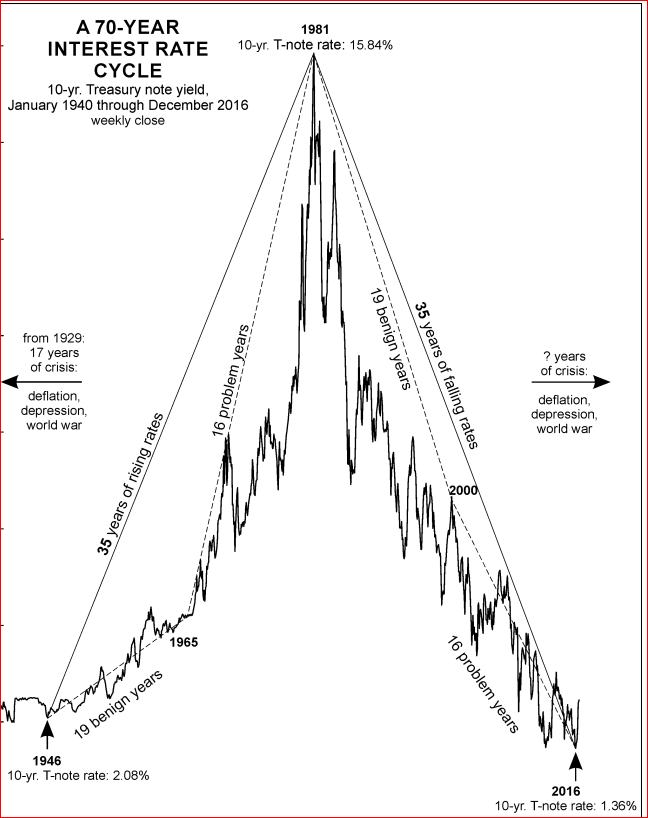

While he notes we are in just the early stages of the bond bear market, Prechter writes, “As interest rates rise, the burden of a record level of worldwide debt will become intolerable. Defaults will occur in a flood. That time still lies ahead, but it is coming.”

Perhaps it starts this summer. Gross points out that the European Central Bank is currently buying 80 billion euros ($85.7 billion) a month in bonds and Japan's 10-year is pinned at zero to 10 basis points.

"Once [ECB President Mario] Draghi begins to taper, that probably won't happen for a few months, but once he begins to taper and reduce that $80 billion a month, once that zero to 10 basis point cap is eliminated in Japan, then hell could break loose in terms of the bond market on a global basis," Grant told "Power Lunch."

For the tranquil moment here in the U.S., Fed governor Daniel Tarullo is resigning and Danielle DiMartino Booth, author of "Fed Up: An Insider's Take on Why the Federal Reserve Is Bad for America," believes board member Lael Brainard will also leave.

The result, according to DiMartino Booth, "It's really going to come down to whether or not he's got the gumption to totally change the complexion of the Federal Reserve board, or if he steps back and says, 'You know what, I've got to finance all this stuff, so I'm going to put more doves in.' These are hard decisions."

The ex- Fed employee knows the central bank is not a place for those who question the current Keynesian orthodoxy. "It is a culture where you're not allowed to raise your hand and say, 'You know what? There's something wrong with this picture.'"

DiMartino Booth, while critical of the Fed’s army of PhD’s and their groupthink (she dubs it “groupstink”), she still believes America requires a strong central bank. However, whether the Fed is loaded with business types not chained to IS-LM curves and the paradox of thrift, or academics wrapped up in their models, as Prechter writes, the Fed does not act, but reacts, with “no basis upon which to forecast its reactions.”

“The bull run is definitely over,” said Louise Yamada, who heads her namesake technical research firm in New York and is a chartered market technician. “There will be a very slow multi-year incremental increase in interest rates.”

"Very slow" she says. No one seems to understand they don’t know what they don’t know.